Building credit in US

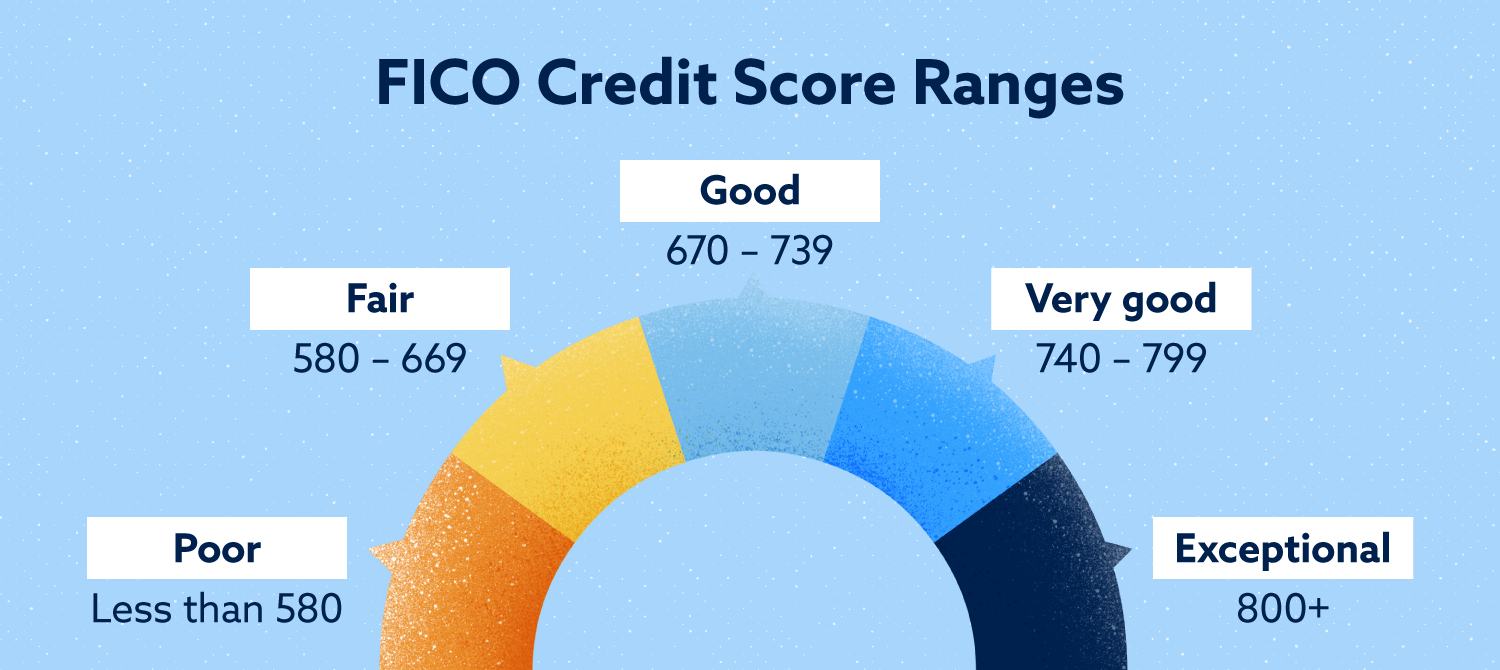

“A credit score is a number that creditors use to determine your credit behavior, including how likely you are to make payments on a loan. Having a high credit score can make it easier to get a loan, rent an apartment, or lower your insurance rate. Learn how to get your credit score, how it is calculated, and what you can do to improve it.”(US Government)

High credit scores leads to high credit limits. A person with high income might not get high credit limits if his/her credit score is low.

FICO Score

Some quantified scores are used to evaluate one’s credit, like FICO Scores and VantageScores. We can check our credit scores for free in credit karima, or our credit cards’ banks like Bank of America and Discover.

Credit bureaus(Equifax, Experian and TransUnion) are legally obligated to give everyone a free credit report once a year. Credit report give suggestions on how to increase credit.

How to increase FICO score

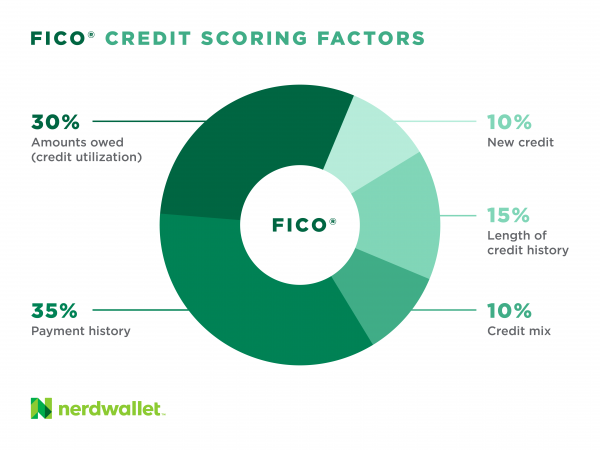

- Pay every bill on time

- Use less than 30-50% of credit card limit. Or banks view you as a higher credit risk.

- Keep old credit account. Length of credit history is essential.

- Have mixed credit types(if you can manage them all). Like not only pay credit cards on time, but also use other service like Affirm in Amazon, or all kinds of loan.

- Avoid frequent “Hard inquiries”. When apply for a new credit card, the bank make a hard inquiry which decreases our score temporarily.

Great credit cards for college students

Website:1https://www.nerdwallet.com/best/credit-cards/college-student

Website 2:https://xscholarship.com/best-credit-cards-for-students/

Personal favorite:

BoA: Travel Rewards Credit Card for Students

Discover:Discover Student Cash Back Card

Comments

Post a Comment